Urea fertilizer is loaded and dumped into a transfer hopper at the Southwest Terminal near Gull Lake, Sask. | William DeKay photo

Fertilizer industry executives say urea supplies will become tighter in 2019 and beyond.

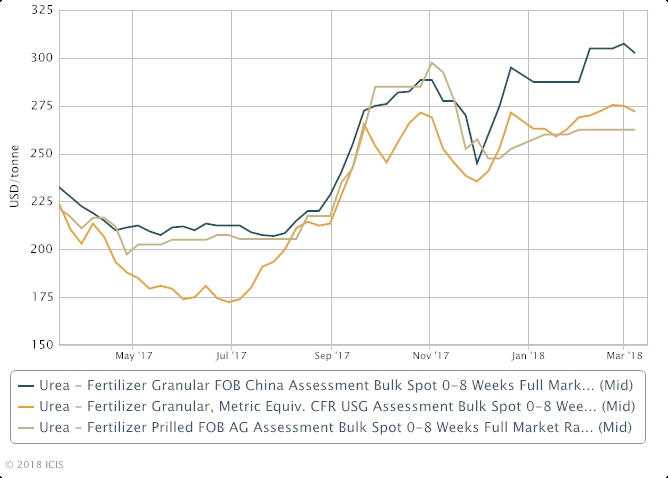

The combination of vastly reduced exports out of China and the slowdown in new capacity coming on line is closing the gap between supply and demand and driving prices higher.

China exported 2.4 million tonnes of urea in the 12 months ending July 31, 2018. Its previous record was 16.2 million tonnes for the 12 months ending June 30, 2015.

Exports through the first seven months of 2018 were 800,000 tonnes, a 74 percent reduction from the same period in 2017. Shipments have been nearly non-existent the past few months.

China has been consolidating and shutting down capacity as nitrogen fertilizer prices languish and the government cracks down on coal-based pollution.

Jason Newton, head of market research at Nutrien, said another factor behind escalating urea prices is the rising cost of production in marginal cost regions.

Anthracite coal prices are on the rise in China and natural gas prices have followed crude oil prices higher in Europe, which is pushing nitrogen fertilizer prices up in markets like Ukraine and elsewhere.

The year-to-date average price for Middle East granular urea is up $30 to $40 per tonne over the same period a year ago and today’s price is up $100 per tonne over a year ago.

Newton said there has been little incentive for manufacturers to add new production capacity the last three years or so due to depressed nitrogen prices.

The result is there is limited new capacity coming on stream in 2019 and beyond. Meanwhile, demand continues to grow at a steady pace of about two million additional tonnes per year.

“We expect that the market will tighten further as we go forward to 2019 and beyond because there’s not a lot of new projects in the pipeline,” he said.

Newton wasn’t willing to speculate how much further urea prices could escalate because there are too many factors involved, including where crude oil prices go.

Todd Lewis, president of the Agricultural Producers Association of Saskatchewan, said farmers have taken notice of rising nitrogen fertilizer prices.

“Western Canada should be one of the cheapest places in the world to make nitrogen fertilizer but it’s also one of the most expensive places in the world to buy it,” he said.

Part of the problem is the weak Canadian dollar because nitrogen fertilizer is priced in U.S. dollars.

He warned that with low commodity prices fertilizer manufacturers better make sure that nitrogen prices don’t get too far out of line.

“Eventually they’ll just price themselves out of use,” said Lewis.

He said growers will switch to growing nitrogen fixing crops such as soybeans, lentils and peas.

Newton said nitrogen fertilizer prices in North America are still very much influenced by the global market because while there is plenty of new production capacity in the U.S. there is still a need to import product.

The good news is that the reduced reliance on imports should also decrease the amount of price volatility there has been in the past.

“We certainly saw this year not as much volatility going into the spring season as what has historically been the case,” he said.

ABOUT THE AUTHOR

Sean Pratt's recent articles

Source from: www.producer.com