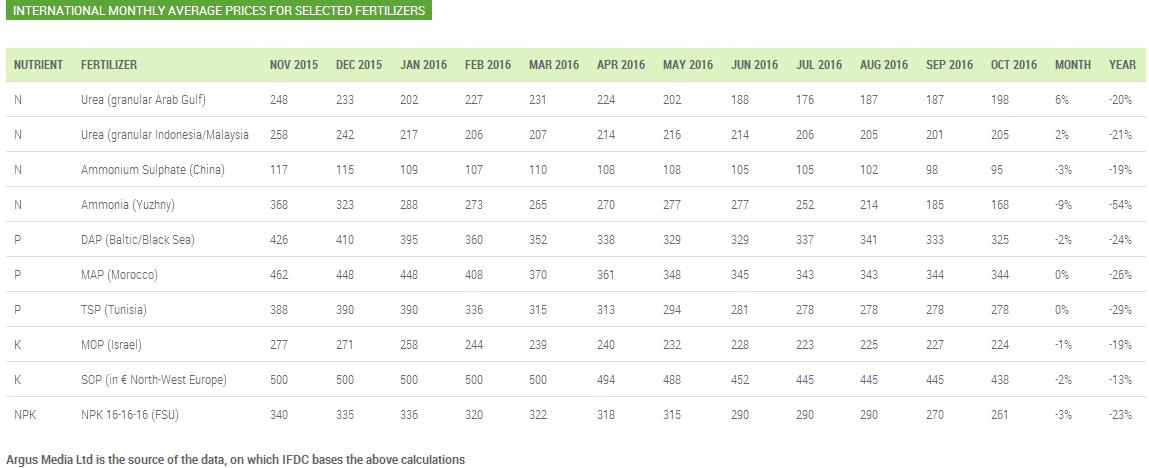

NITROGEN

Urea market maintained firm tone: having risen by $20-25/t since September, the question of whether urea prices would continue to firm came under scrutiny in discussions on the fringes of two industry conferences during the last week of October. The conclusion was that they probably will in the West, but there was less conviction about Chinese price levels firming further in the East. North African producers sold granular urea at prices of $220- 222/t fob in the last week of October for November and December shipment, up around $5/t from the previous week. Numerous European buyers descended on Cannes, France, at the Argus FMB Europe conference, which attracted about 700 delegates. Most of the buyers still had urea to purchase for shipment before the end of 2016. Offers were about $30/t higher than in the last round of selling and most were seeking reassurance that prices would not turn down again in the near term. Given the widespread belief that the US was short of urea and would start to buy spot cargoes and seeing Brazilian prices move up another $4-5/t, the reassurance was provided. In the East, attention was turning increasingly to the upcoming Indian tender, it was expected to be issued in the first week of November, as the next significant piece of demand. Chinese producers were asking $215-220/t fob for prilled and granular urea. Some sales, including one Fudao cargo, were reported at $215/t fob. Low production levels and a strengthening domestic market were supporting prices in the export market. The overall outlook was firm for the next 30-45 days and some additional price gains were likely.

EGYPT

Abu Qir held a sales tender on 27 October for 20,000t of granular urea for shipment 28 November-12 December. Dreymoor bought the full tonnage at $220/t fob. Other producers offered their remaining November tonnage at $220/t fob, and aimed to secure further business in Europe and Turkey. On 27 October, Mopco sold 25- 30,000t to Yara at $220/t fob. Alexfert sold 5-10,000t at the same price.

ALGERIA

AOA continued negotiations in the last week of October with traders who bid in its 21 October sales tender, but no sales were reported for non-European destinations. Traders bid at prices below $215/t fob. AOA scheduled another tender for 28 October. Sorfert was reported to have sold at $222-223/t fob for November shipment, understood to be to a European destination, and claimed business up to $225/t fob based on premiums over Egyptian prices.

NIGERIA

Production at Indorama’s plant has attained about 90pc of capacity, equivalent to about 110,000t/month. Trammo fixed a vessel to load 32-33,000t in Onne 26-28 October for Brazil at $10.25/t, the first cargo to be shipped from Indorama’s new plant to Brazil. Helm will load 25- 30,000t for Brazil after this vessel. Nitron and Keytrade also have cargoes to load in November.

PHOSPHATE

The phosphates market drifted down in a vacuum of demand. India remained absent due to high stocks and a narrowed import window (it was Diwali during the first week of November, after which fresh DAP arrivals had perhaps less than two weeks to arrive in time for the current season). After this time, any new cargoes would go into storage, and no one was prepared to take a risk with stocks high and the subsidy uncertain. By contrast Pakistan continued to buy imported DAP with two more deals done the last week of October for Chinese and Australian material totalling 80,000t, bringing total imports to around 1.13 mnt. Normally this would be considered a very healthy level, but such volumes do not begin to offset the lack of Indian buying. At least prices were stable in the mid/high-$310s/t cfr. With Saudi product excluded and Chinese production running at low rates, perhaps buying options were thin. Elsewhere, the TSP market was active with both GCT and OCP understood to have agreed supply contracts with BADC Bangladesh for 2017 totalling 300,000t. The TSP market remains a very niche and much tighter market than other phosphates. Iran also tendered for 150,000t and an award was expected the last weekend of October. Chinese product was expected to dominate although there were also offers from Lebanon and North Africa in addition to the usual Bulgarian presence. West of Suez, Brazilian MAP cfr prices slipped again in a vacuum of demand to $335-345/t cfr on bids/offers while the European DAP fca price dropped to $350/t amid oversupply and lacklustre interest. Tampa was not tested in the last week of October. Argentina was also quie

KENYA

Negotiations under the 22 September DAP tender for 40,000t were proceeding slowly. Technical offers were been evaluated and several local suppliers were rejected at this stage. Prices were being discussed but no award was confirmed at the time of writing. Origin and prices have not been revealed.

MOROCCO

There were reports OCP has agreed a 50,000t DAP supply deal with BADC Bangladesh under the usual government-to government arrangement.

OCP Morocco October commitments ('000t)

Europe/Turkey 100

Africa 130

Brazil 150

Domestic 70

September carryover commitments 150

TOTAL 600

PRODUCTION 580

BALANCE -20

TUNISIA

GCT made no fresh sales to Europe or Turkey, preferring to wait for a major European fertilizer conference that took place in the last week of October. Production continued to run on one line at Gabes and GCT reported no phosphate rock supply issues.

POTASH

The fertilizer markets met in Cannes and Singapore in late October, and potash suppliers have already started to muse on the timings of the next China MOP contract decisions. With many suppliers sold out for the fourth quarter, and the general consensus being that the period will be an improvement in terms of demand compared with the rest of the year, suppliers were looking towards 2017 with strong hopes of an early settlement driving stability and buying confidence. PotashCorp was broadly optimistic for the fourth quarter in its results released on 27 October, expected stronger engagement from buyers. Spot potash prices have climbed by approximately 15pc from a low point earlier this year, the firm said. But its average realised potash price in the third quarter was still $100/t down on the year, at $150/t. In the market for the last week of October, the Brazilian price assessment widened to $230-240/t cfr for granular MOP, as buyers were still able to secure product at the low end, despite some suppliers chasing as much as $245/t cfr. In Europe, ICL and other suppliers made the decision to up their price offers for granular MOP to €245/t cfr. The company was short of granular MOP and saw no reason to sell for less. And in Southeast Asia, more tenders were expected soon in Malaysia and Indonesia.

IVORY COAST

Morocco’s OCP found a supplier for its 3,000t of MOP requirements, after it struggled to acquire some of the necessary raw materials to begin NPK blending at Sea Invest's facility in Abidjan, Ivory Coast in mid-October, according to market participants. OCP intends to blend 0-23-19 for cocoa and 15-15-15+6S+1B for cotton. The blends from this unit will move domestically, as well as to nearby countries. OCP had previously made blends in Jorf Lasfar but the location of Abidjan will be more favourable to meet demand in nearby markets.

SOUTH AFRICA

South Africa’s imports of MOP totalled 136,059t in January- August, a drop of 24pc compared with the 179,307t imported during the same period of last year, according to GTIS data. Chile remained the country’s top MOP supplier, providing 47,250t — or 35pc — of the January-August total. South Africa imported 51,608t in August, a year-on-year decrease of 26pc.

Source: africafertilizer.org